Corporate Communications

30.03.2015

IMMOFINANZ - Q&A on the extraordinary general meeting

Below you can find questions and asnwers on our extraordinary general m

eeting. For further English Information refer to:

http://www.immofinanz.com/en/investor-relations/general-meeting/Why has IMMOFINANZ announced an extraordinary general meeting?

IMMOFINANZ will hold an extraordinary general meeting on 17 April 2015. We are organising this meeting to request the authorisation of our shareholders for a voluntary partial public offer by IMMOFINANZ for shares in CA Immobilien Anlagen AG. We will also recommend a number of changes to the articles of association, among others a reduction to 15% in the so-called control threshold that triggers a mandatory public takeover offer. Other proposals involve a reduction in the number of Supervisory Board members to be elected by the general meeting from the previous level of 18 to six and an increase in the Supervisory Board from four to six members through the election of two new members.

Why did IMMOFINANZ announce a partial public offer for up to 29% of the shares of CA Immobilien Anlagen AG?

We expressed our interest in this smaller competitor already last year when UniCredit Bank Austria decided to sell its stake in CA Immo. CA Immo fits very well with IMMOFINANZ as regards the core countries and asset classes, and the realisation of synergies would be possible if both companies continue their expansion in these markets. If our offer is successful, further steps would be reasonable.

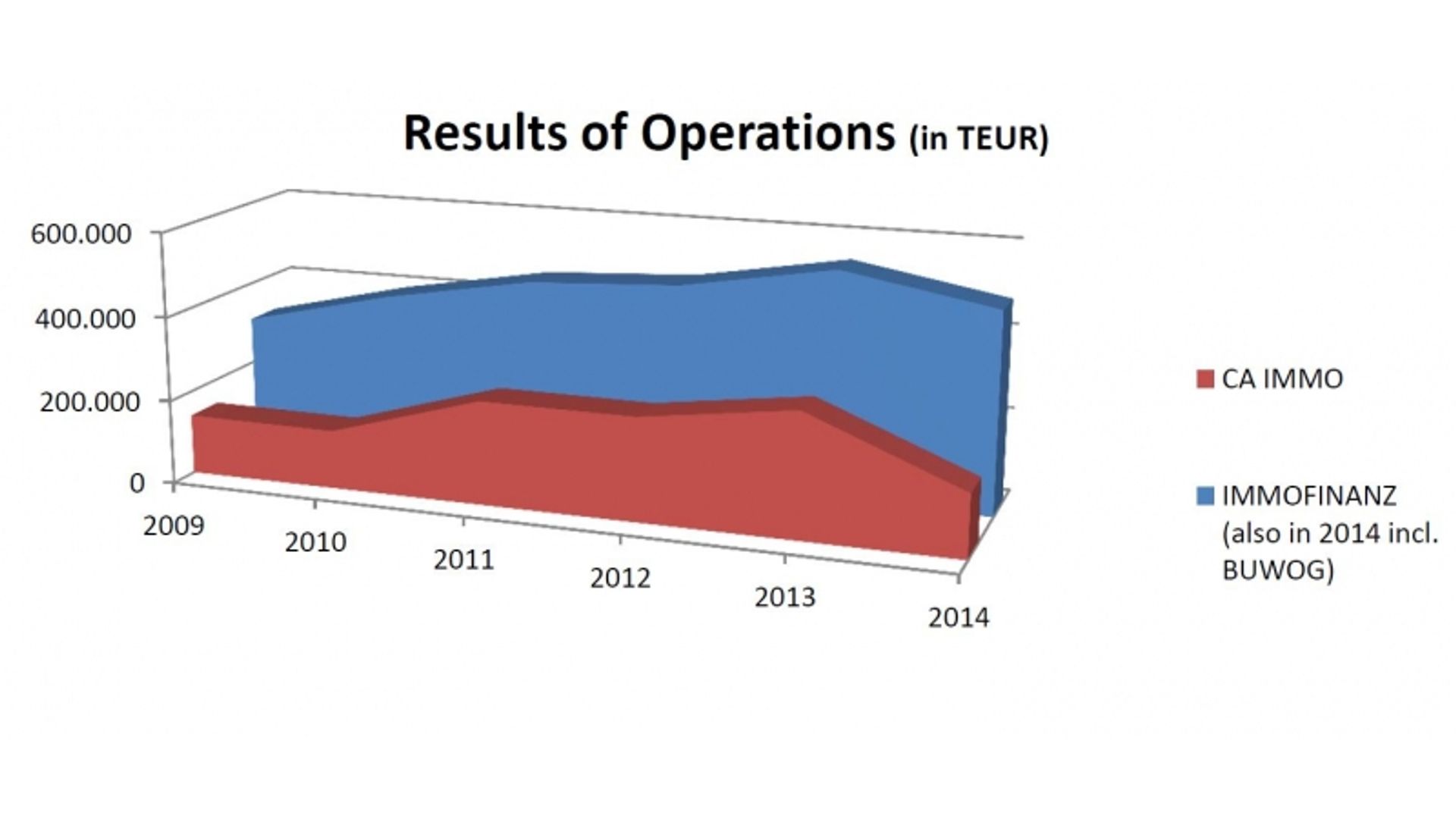

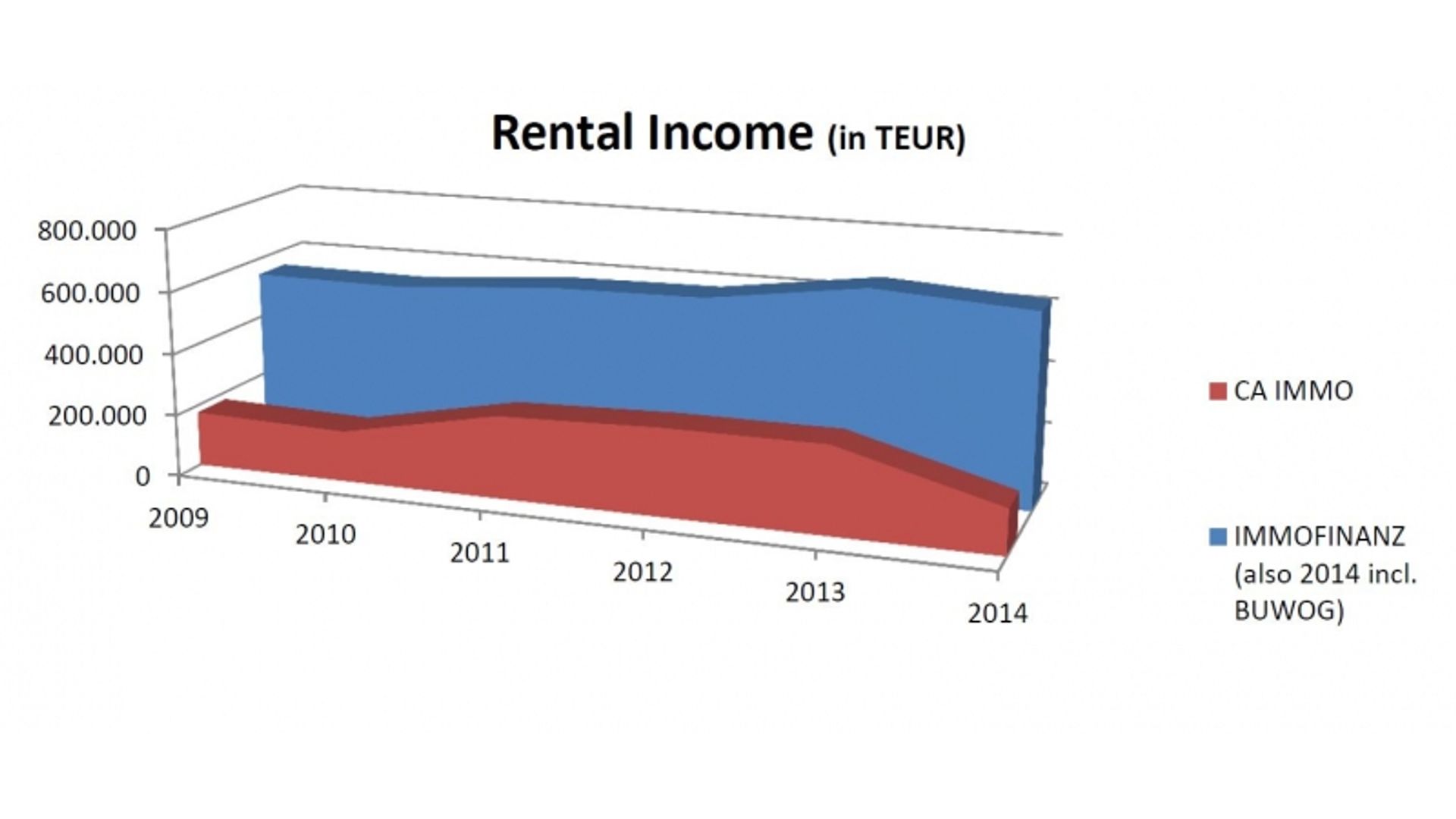

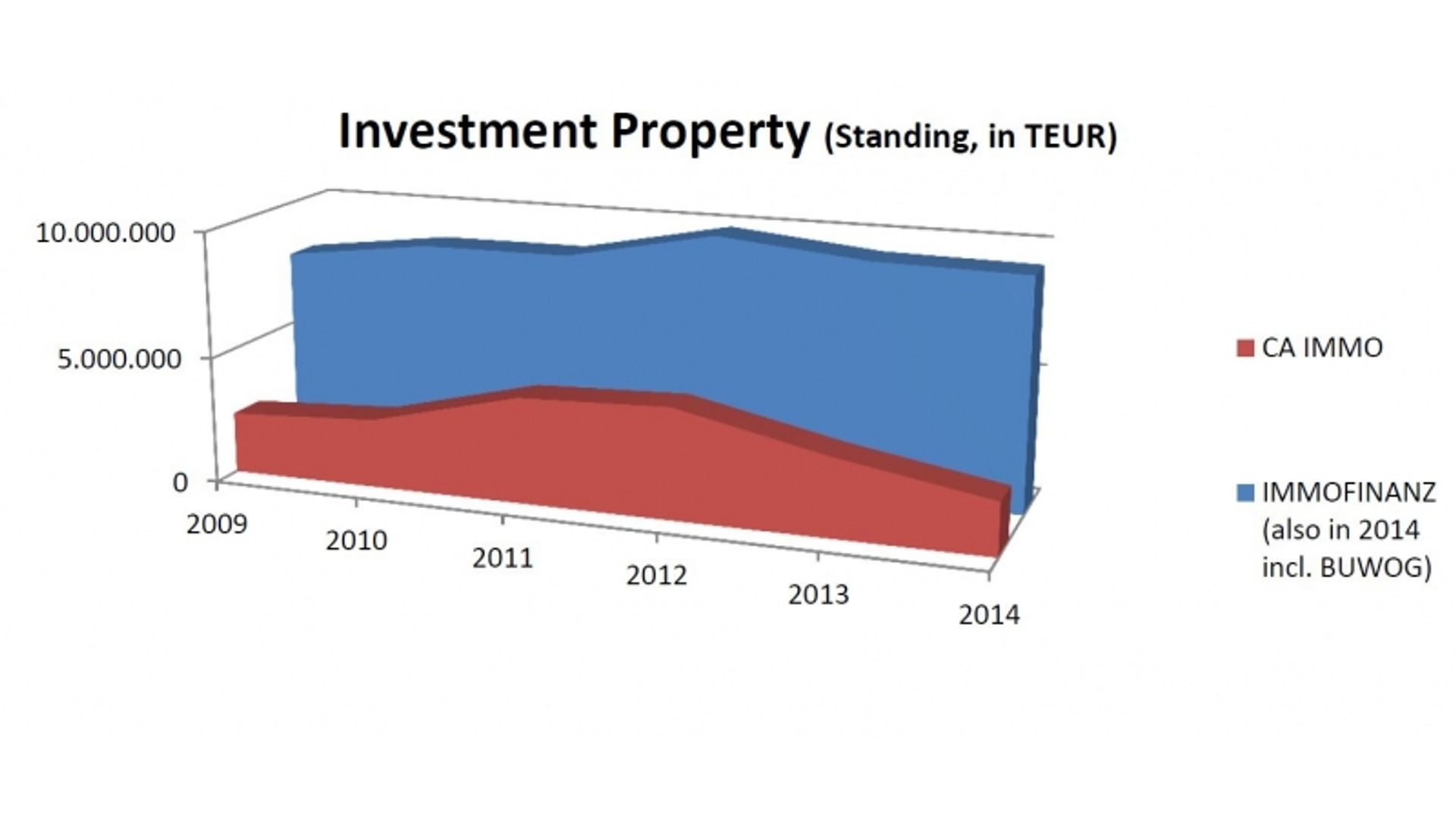

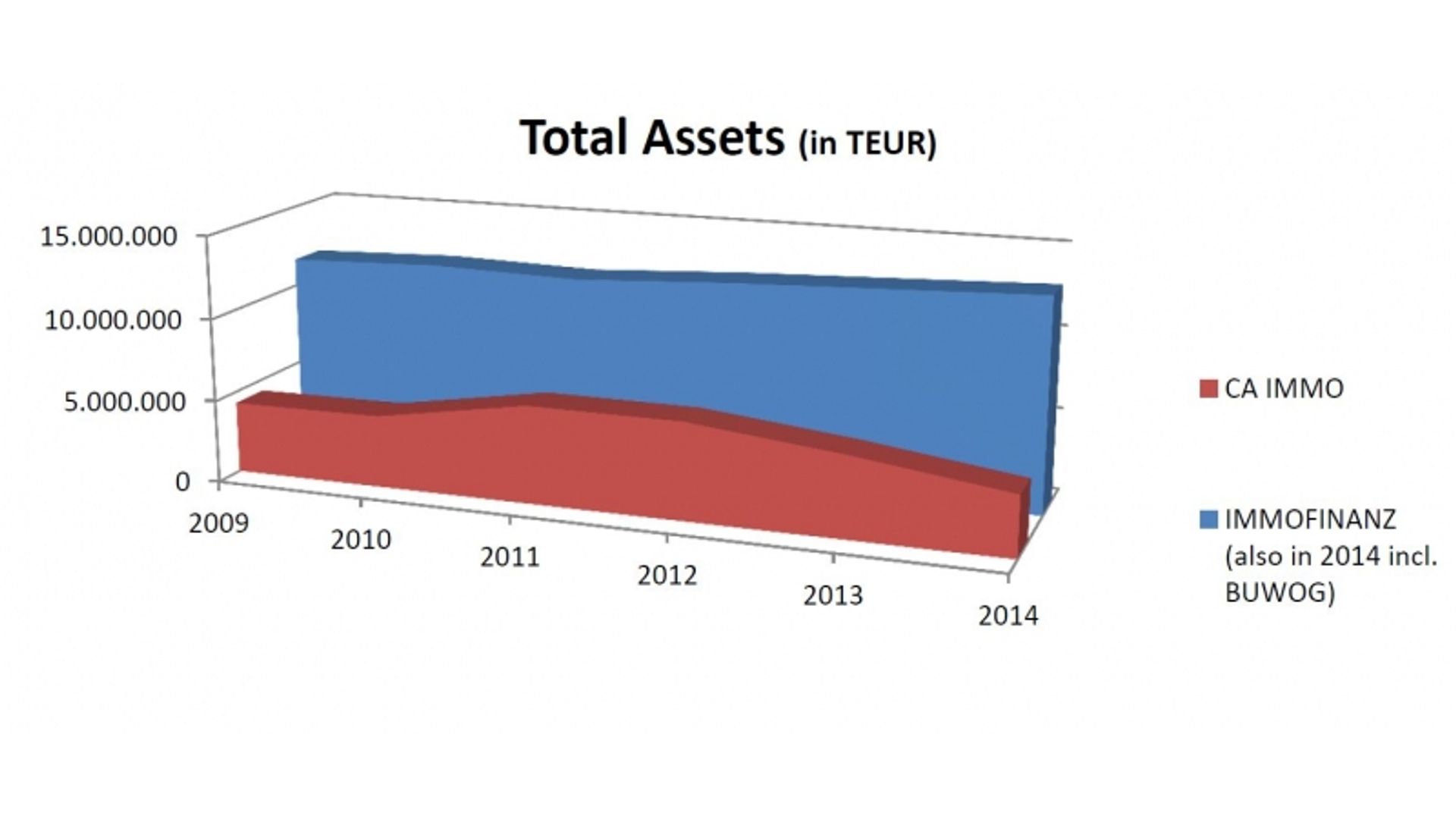

IMMOFINANZ is – with a market capitalisation of approx. EUR 3,000 million – not only the largest listed real estate company in Austria, but one of the leading real estate investors and developers in Central Europe. Despite numerous profitable property sales in recent years (nearly EUR 2.7 billion during the 2010/11 to 2013/14 financial years), we have increased our balance sheet total and real estate assets through our development activities – while these indicators for CA Immo show a downward trend. (You can find a comparison in graph form at the end of the blog. In contrast to the published annual financial statements for 2013/14, the IMMOFINANZ data in this comparison for the 2013/14 financial year also include 100% of BUWOG which was spun off at the end of April 2014.).

You can find additional background information in the following blog:

http://blog.immofinanz.com/en/2015/03/23/immofinanz-we-want-to-gain-control-over-ca-immo/

Why did the IMMOFINANZ Executive Board and the Supervisory Board decide to request the authorisation of the general meeting for a partial offer to the shareholders of CA Immo?

With this step, we are following a recommendation by the Austrian Takeover Commission.

What is the reason for the proposed reduction in the control threshold defined by § 22 (2) of the Austrian Takeover Act?

IMMOFINANZ has a widely diversified shareholder structure, and 100% of the company’s shares are held in free float. An investor who holds 15% of the voting rights can achieve a relative majority of the voting rights at a general meeting because of the number of shareholders who actually attend which, in turn, can give a single investor control over the company. In view of this situation, the threshold defined in the Austrian Takeover Act – i.e. 30% of voting rights – appears to be too high. A reduction of the threshold would provide additional protection for shareholders by guaranteeing a control premium.

Other ATX companies with a high free float component – Erste Group and Wienerberger – have, in the past, also reduced the control threshold below the legally defined 30% limit.

Why will the extraordinary general meeting be asked to approve a reduction from 18 to 6 in the maximum number of number of Supervisory Board members to be elected by the general meeting?

Because 18 is a very high number – and is generally not used by IMMOFINANZ. The extraordinary general meeting will therefore be asked to reduce the maximum number to six members. This size is adequate for a company like IMMOFINANZ. Andritz – which is also included in the ATX five index of the Vienna Stock Exchange – also set a limit of six for the number of Supervisory Board members to be elected by the general meeting.

What proposed change to the articles of association is related to the term of office on the Supervisory Board, and what is the reason?

The proposal to the extraordinary general meeting states that the election of a substitute member to the Supervisory Board will cover the remaining term of office of the departing member. The previous text indicates that the term of office for a Supervisory Board member elected by an extraordinary general meeting must end with the close of the next annual general meeting. The extraordinary general meeting will be asked to approve this change.

The reason: there is no qualitative difference between the election of a Supervisory Board member by an extraordinary or ordinary general meeting.

eeting. For further English Information refer to:

http://www.immofinanz.com/en/investor-relations/general-meeting/Why has IMMOFINANZ announced an extraordinary general meeting?

IMMOFINANZ will hold an extraordinary general meeting on 17 April 2015. We are organising this meeting to request the authorisation of our shareholders for a voluntary partial public offer by IMMOFINANZ for shares in CA Immobilien Anlagen AG. We will also recommend a number of changes to the articles of association, among others a reduction to 15% in the so-called control threshold that triggers a mandatory public takeover offer. Other proposals involve a reduction in the number of Supervisory Board members to be elected by the general meeting from the previous level of 18 to six and an increase in the Supervisory Board from four to six members through the election of two new members.

Why did IMMOFINANZ announce a partial public offer for up to 29% of the shares of CA Immobilien Anlagen AG?

We expressed our interest in this smaller competitor already last year when UniCredit Bank Austria decided to sell its stake in CA Immo. CA Immo fits very well with IMMOFINANZ as regards the core countries and asset classes, and the realisation of synergies would be possible if both companies continue their expansion in these markets. If our offer is successful, further steps would be reasonable.

IMMOFINANZ is – with a market capitalisation of approx. EUR 3,000 million – not only the largest listed real estate company in Austria, but one of the leading real estate investors and developers in Central Europe. Despite numerous profitable property sales in recent years (nearly EUR 2.7 billion during the 2010/11 to 2013/14 financial years), we have increased our balance sheet total and real estate assets through our development activities – while these indicators for CA Immo show a downward trend. (You can find a comparison in graph form at the end of the blog. In contrast to the published annual financial statements for 2013/14, the IMMOFINANZ data in this comparison for the 2013/14 financial year also include 100% of BUWOG which was spun off at the end of April 2014.).

You can find additional background information in the following blog:

http://blog.immofinanz.com/en/2015/03/23/immofinanz-we-want-to-gain-control-over-ca-immo/

Why did the IMMOFINANZ Executive Board and the Supervisory Board decide to request the authorisation of the general meeting for a partial offer to the shareholders of CA Immo?

With this step, we are following a recommendation by the Austrian Takeover Commission.

What is the reason for the proposed reduction in the control threshold defined by § 22 (2) of the Austrian Takeover Act?

IMMOFINANZ has a widely diversified shareholder structure, and 100% of the company’s shares are held in free float. An investor who holds 15% of the voting rights can achieve a relative majority of the voting rights at a general meeting because of the number of shareholders who actually attend which, in turn, can give a single investor control over the company. In view of this situation, the threshold defined in the Austrian Takeover Act – i.e. 30% of voting rights – appears to be too high. A reduction of the threshold would provide additional protection for shareholders by guaranteeing a control premium.

Other ATX companies with a high free float component – Erste Group and Wienerberger – have, in the past, also reduced the control threshold below the legally defined 30% limit.

Why will the extraordinary general meeting be asked to approve a reduction from 18 to 6 in the maximum number of number of Supervisory Board members to be elected by the general meeting?

Because 18 is a very high number – and is generally not used by IMMOFINANZ. The extraordinary general meeting will therefore be asked to reduce the maximum number to six members. This size is adequate for a company like IMMOFINANZ. Andritz – which is also included in the ATX five index of the Vienna Stock Exchange – also set a limit of six for the number of Supervisory Board members to be elected by the general meeting.

What proposed change to the articles of association is related to the term of office on the Supervisory Board, and what is the reason?

The proposal to the extraordinary general meeting states that the election of a substitute member to the Supervisory Board will cover the remaining term of office of the departing member. The previous text indicates that the term of office for a Supervisory Board member elected by an extraordinary general meeting must end with the close of the next annual general meeting. The extraordinary general meeting will be asked to approve this change.

The reason: there is no qualitative difference between the election of a Supervisory Board member by an extraordinary or ordinary general meeting.