- homeCPI Europekeyboard_arrow_down

- Home

- Office keyboard_arrow_right

- Retail keyboard_arrow_right

- Company keyboard_arrow_right

- Investor Relations keyboard_arrow_right

- Newsroom keyboard_arrow_right

- Sustainability

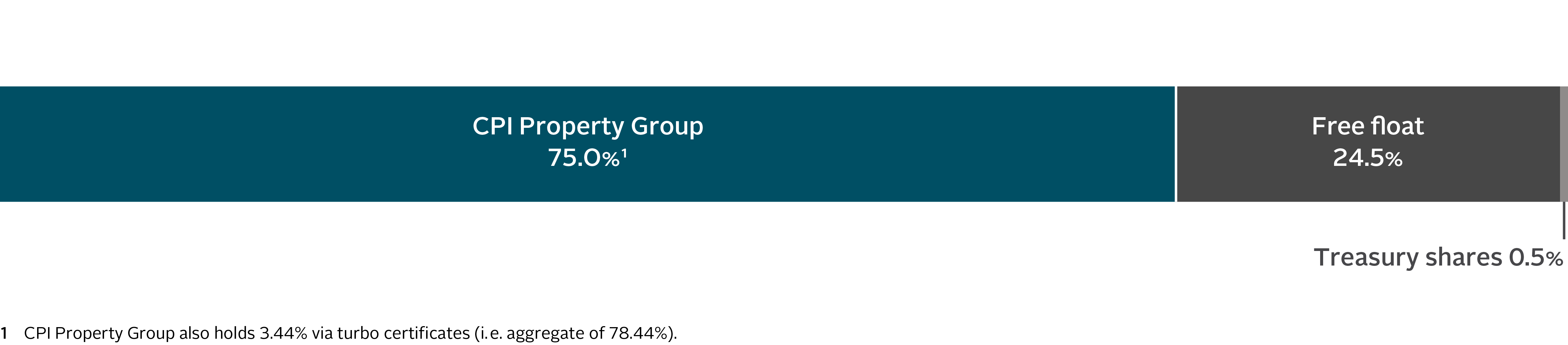

Shareholders' Structure

The CPI Property Group has been the majority shareholder of IMMOFINANZ AG since May 2022. This gives us a very large, long-term oriented core shareholder and makes us part of a successful group with a property portfolio of roughly EUR 19 billion and extensive expertise in Central and Eastern Europe.

The CPI Property Group currently holds 75.00% of the voting rights attached to our shares and 3.44% through financial/other instruments (turbo certificates), i.e. a total of 78.44%.

The remaining shares are held by Austrian private investors and long-term oriented institutional investors from Europe and the USA.

Details on the shareholding can be found in the respective shareholding notification in the newsroom.

Subscribe to our newsletter

Our CPI Europe-Newsletter provides you with updates on a regular basis.

Company

Investor Relations

© 2025

CPI Europe. All Rights Reserved.