Sustainability at CPI Europe

"We are well aware of our responsibility and have been addressing sustainability trends in our portfolio strategy for many years."

Our sustainability strategy and goals

CPI Europe is one of the leading commercial real estate specialists in Central and Eastern Europe and an active portfolio manager of office and retail properties. The size of this portfolio gives rise to a particular responsibility for us – in economic, social and ecological terms – towards our stakeholders, the environment and society. Our business model is therefore oriented towards long-term, sustainable value creation in line with environmental, economic and social considerations.

The Code of Business Ethics and Conduct forms the basis for exercising our responsibility and for all business activities and decisions within the company. It sets out the fundamental approach and values for responsible corporate governance at CPI Europe. We ensure that we interact responsibly with the environment, employees, customers and business practices.

Our basic approach to respecting human rights and to fair working conditions covers both our own business activities and our entire supply and value chain. In our own activities we are always guided by the maxim to neither cause nor contribute to human rights abuses. All our employees are required to comply with the standards and guidelines set out in our Policy Statement on Respecting Human Rights.

The principles of responsible management also includes our clear commitment to and the support of internationally recognised human rights. In particular, we are committed to our social and societal responsibility by participating in the United Nations Global Compact.

CPI Europe has been participating in the UN Global Compact, the world's largest initiative for corporate responsibility and sustainability, since 31 January 2022 and is thus actively involved in the implementation of the Ten Principles of the UN Global Compact as well as the UN Sustainable Development Goals (SDGs).

Sustainability Projects & News

“The acute climate crisis and the related ecological impact are the most pressing challenges of our time, and we are all called on to act. We have therefore set the goal to massively reduce our greenhouse gas emissions. That reflects our commitment to accept responsibility for mankind and our environment as well as our intention to play a leading role in the sustainable transformation of our industry.”

Sustainability is a daily routine in our VIVO! Shopping Centers

Whether it is office or retail, our approach towards ESG topics is equally important. You will be surprised by the wide scope and the amount of sustainability initiatives that we actually implemented and plan to continue. Enjoy the video showing our ESG measures in our VIVO! shopping centers.

Our sustainability strategy and goals

CPI Europe views itself as a partner to its stakeholders and is above all committed to its tenants and their customers with the assurance of quality and safety. Sustainability factors are incorporated in the planning, construction and operation of our properties in order to meet the needs of our stakeholders and to minimise the environmental impact through business activities. The constant reduction in the CO2 footprint of our portfolio, through usage of environmentally friendly technology and the systematic improvement of the portfolio’s energy efficiency, constitutes part of our sustainability strategy.

CPI Europe is currently working intensively on measures and the formulation of quantitative targets to achieve long-term climate neutrality in its portfolio and has the objective of continuously improving the portfolio’s resource utilisation efficiency.

We are making an important contribution to the fight against climate change with our new Net Zero Emission Strategy. Plans call for a reduction of 60% (below the 2019 level) in all greenhouse gas emissions by 2030 – and by 2040, we intend to be emission-free along the entire value chain. That means CPI Europe will clearly exceed the goal set by the European Union to attain climate neutrality by 2050.

The real estate sector plays a decisive role in the fight against the steadily progressing climate change. Roughly 40% of worldwide emissions are attributable to the construction or operation of buildings. In order to limit global warming to a maximum of 1.5°C, numerous measures are urgently needed. CPI Europe, as one of the leading commercial real estate companies in Europe, has accepted this responsibility and intends to become emission-free by 2040.

A key area of strategic focus is also on tenant loyalty, driven by strong customer satisfaction, and attracting new tenants. CPI Europe’s brands serve as a commitment to service and quality in this respect.

Our employees are the foundation of our activities. They bring our values to life and their commitment guarantees a high level of customer satisfaction. We aim to create a work environment based on openness and mutual respect throughout the Group. Especially in times of overall uncertainty, our positioning as a stable employer that is resilient to crises is particularly important.

Integration of sustainability in governance processes

The Executive Board is responsible for CPI Europe’s strategic direction and sustainable company performance. The Supervisory Board supports and advises the Executive Board. The sustainability management strategic focal points are based on the materiality analysis conducted in 2020.

Materiality analysis

Update on our materiality analysis

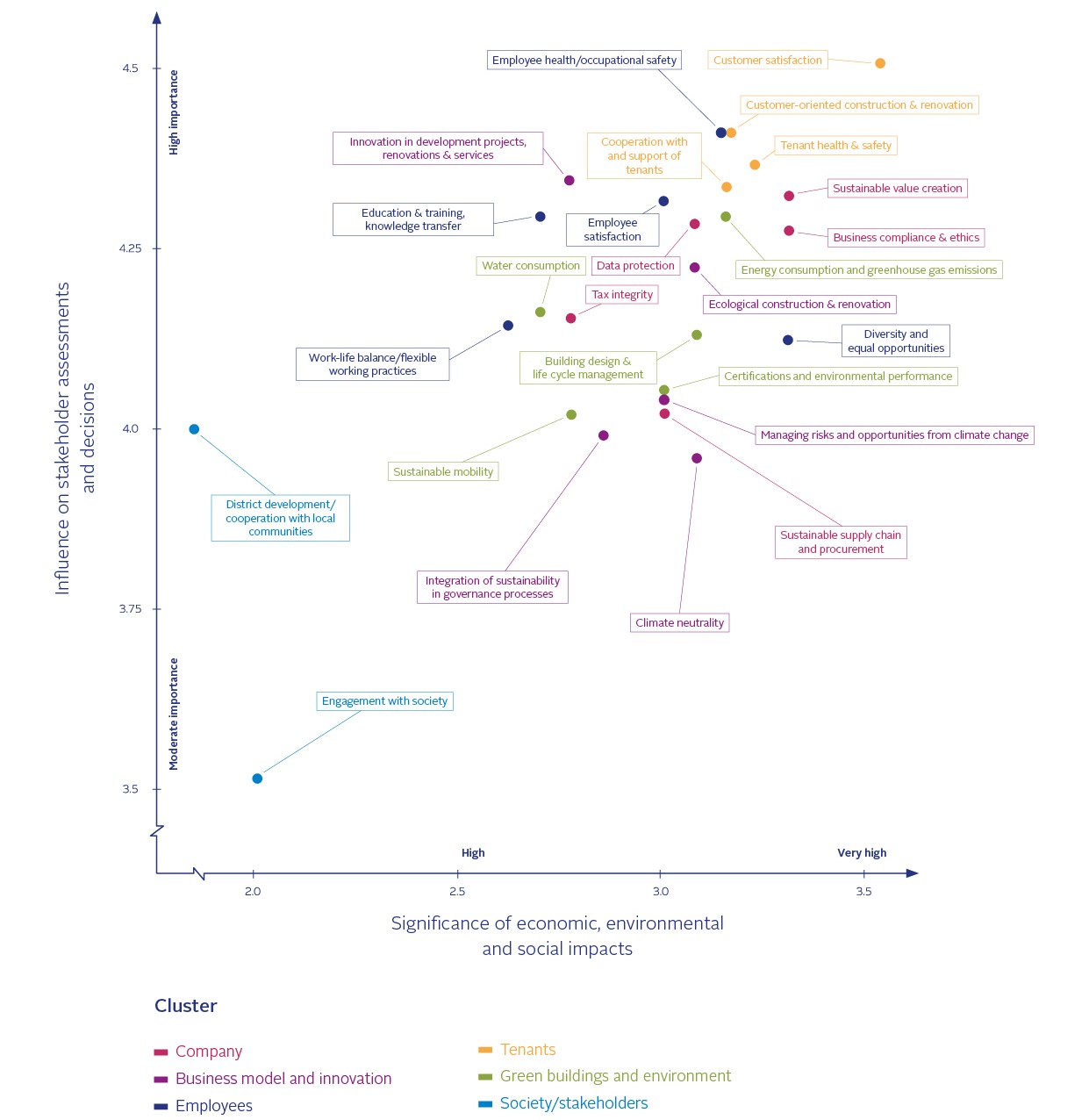

In 2020 we updated our materiality analysis and involved external stakeholders in the process. This helps us to prioritise those ESG issues that are most important for our business model. The results from the previous analysis conducted in 2017 formed the basis for the process. In an internal expert workshop held in order to specify and assess economic, environmental and social impacts, management from all business areas reviewed the previous material issues to evaluate their current applicability and relevance and identify missing focal points.

Materiality matrix

The y-axis shows the extent of the influence on stakeholder assessments and decisions. The x-axis shows the significance of the economic, environmental and social impacts that result from CPI Europe’s activities.

Sustainability reporting

In our non-financial statement you can find out what goals we have set ourselves and how we plan to achieve them. The statement contains important facts and data on our responsibility towards the environment, tenants and customers, as well as towards employees and our business practices.

The non-financial statement is part of the group management report and is published in the annual financial report and the annual report. We received for the first time the EPRA Sustainability Best Practices Recommendations GOLD for our non-financial reporting in the 2022 Annual Report (after silver in previous years).

Green Financing & ESG Rating

Investing sustainably

More and more investors are basing their investment decisions on criteria such as environmental protection, social behaviour and fair corporate governance. They want to invest in companies with a sustainable business strategy.

Sustainability Ratings & Rankings

IMMOFINANZ with low ESG risk assessments by Sustainalytics

Sustainalytics, the world's leading independent provider of ESG and corporate governance research, updated its ESG risk rating for IMMOFINANZ in Q2 2023. The overall rating improved again and is now 12.5 for the 2022 financial year after 13.1 for 2021 and 15.6 for 2020.