Corporate Governance

A commitment to responsibility

As one of the leading commercial property groups in Europe, CPI Europe has a very special responsibility. We believe corporate governance goes far beyond compliance with legal regulations – and are committed to responsible management not only in the interests of our employees, customers and investors but also in support of society and our environment.

All our business activities follow a central goal, namely the creation of sustainable and long-term values. Our actions are governed, among others, by maximum transparency and an open dialogue with all interest groups. This strengthens our position on the capital market and helps us earn the trust of our stakeholders.

"Transparency and open communications with all CPI Europe stakeholders are key elements of our corporate culture."

Commitment to the Austrian Corporate Governance Code

The Austrian Corporate Governance Code provides Austrian stock companies with a framework for corporate management and monitoring. Our Executive Board and Supervisory Board are committed to compliance with the code, in the currently applicable version, and to the related transparency and principles of good management.

The code (version of January 2025) is published below and on the website of the Austrian Working Group for Corporate Governance.

CPI Europe’s compliance with the provisions of the Austrian Corporate Governance Code was evaluated by the auditor, Ernst & Young Wirtschaftsprüfungsgesellschaft m.b.H., within the framework of a separate audit of the corporate governance report (pursuant to KFS/PG 13). The related auditor’s report is available for review below. The evaluation of the corporate governance report for 2024 did not result in any objections.

Articles of Association

For CPI Europe AG, the articles of association represent the essential foundation and create a legally binding framework for the company and its executive bodies. They provide information on the business purpose, share capital and share as well as rules for the executive bodies (Executive Board and Supervisory Board). Issues like the annual general meeting, the annual financial statements and the distribution of profit are also addressed.

Download the documents below for more information:

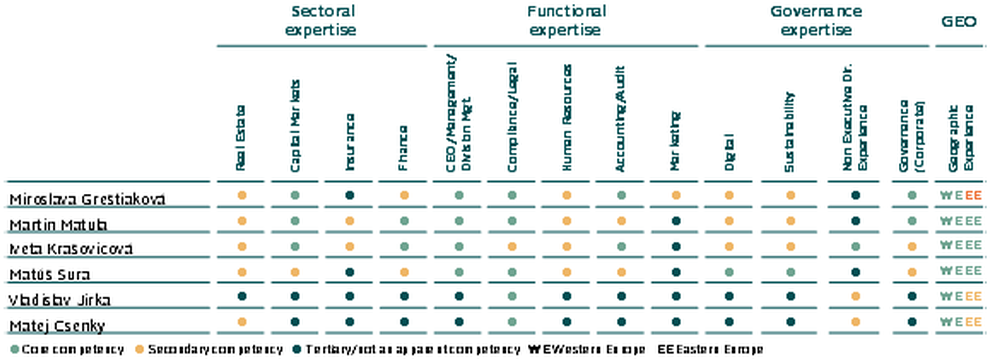

Supervisory Board Qualification Matrix

The Supervisory Board conducts an annual self-evaluation of its working efficiency, above all with regard to its organisation and operating procedures. The focal points include, among others, the organisation of the Supervisory Board and the procedures at meetings, the activities of the committees, the provision of information to the Supervisory Board, the self-image of the Supervisory Board members as well as any recommendations for improvement.

Remuneration Policy and Remuneration Report

For CPI Europe AG, as a listed company, the Supervisory Board has drawn up principles for the remuneration of the members of the Executive Board and Supervisory Board in the Remuneration Policy. This document meets the disclosure requirements resulting from the amendments to the Austrian Stock Corporation Act (“Aktiengesetz“) within the framework of the Austrian Stock Corporation Amendment Act (“Aktienrechts-Änderungsgesetzes”) and also follows the recommendations of the Austrian Corporate Governance Code. The internal requirements of CPI Europe AG which result from the Articles of Association and the Rules of Procedure are also reflected in the Remuneration Policy.

The Remuneration Policy was initially presented to and approved by the annual general meeting in October 2020. Subsequent presentations will be made every fourth financial year and/or in the event of material changes.

Information on the Remuneration Policy for the Executive Board and Supervisory Board is provided in the following documents:

The Remuneration Report provides an annual overview of the remuneration granted to the members of the Executive Board and Supervisory Board during the past financial year within the framework of the respective Remuneration Policy. The first Remuneration Report was presented to the annual general meeting for approval in 2021.

Downloads

Directors' Dealings

The members of the Executive Board and Supervisory Board of CPI Europe AG as well as all closely related persons must report their transactions in CPI Europe financial instruments not only to CPI Europe but also to the Austrian Financial Market Authority (“Finanzmarktaufsicht”, FMA). CPI Europe meets the requirement to report these directors’ dealings, meaning the transactions carried out by these managers, through publication on its website. For further information see the Directors’ Dealings below:

Responsible Business Practices

CPI Europe is committed to business practices which are based on integrity, honesty, fairness, transparency and responsibility. Mutual trust as a fundamental understanding creates the foundation for constructive cooperation throughout the company and with business partners. All activities in the areas of compliance and the fight against corruption, sustainable procurement and human rights are carried out in line with these principles.

The Executive Board has issued numerous corporate guidelines for these areas which cover all CPI Europe employees and group companies: The Code of Business Ethics and Conduct serves as the basis for all entrepreneurial activities and internal decisions and includes, in particular, clear guidelines for the respect of basic rights, integrity and fairness, a ban on discrimination and rules for relations with competitors, customers and professional associations.

Our basic approach to respecting human rights and to fair working conditions covers both our own business activities and our entire supply and value chain. In our own activities we are always guided by the maxim to neither cause nor contribute to human rights abuses. All our employees are required to comply with the standards and guidelines set out in our Policy Statement on Respecting Human Rights. The principles of responsible management also includes our clear commitment to and the support of internationally recognised human rights. In particular, we are committed to our social and societal responsibility through our participation in the United Nations Global Compact.

The anti-corruption directive is based on the UN Convention against Corruption and summarises the principles of conduct and ethical requirements for dealing with corruption.

The compliance directive covers the legal prohibition of the usage of insider information for insider trading and the unlawful sharing of insider information. In addition to regular training, the Compliance Officer is available to employees at any time to answer questions.

The data protection directive contains mandatory regulations on processing personal data in accordance with data protection requirements and the related obligations of all CPI Europe employees. The IT directive serves as the basis for data security and the responsible use of information technology facilities. The directive forms an integral part of employment contracts.

Code of Conduct for Lobbying Activities

The dialogue with political and social decision-makers represents an integral part of our management activities and is a legitimate element of democratic systems. Our Code of Conduct for Lobbying Activities defines six principles in accordance with the Austrian Lobbying and Interest Group Transparency Act (“Lobbying- und Interessenvertretungs-Transparenz-Gesetz”) which govern our contacts with these decision-makers. This Code of Conduct applies to all corporate bodies and employees of CPI Europe AG.

Risk Management

CPI Europe has anchored the handling of risks in a group-wide risk management system. This system is integrated in operating procedures and reporting paths and, in this way, has an influence on processes and strategic decisions. It applies to all levels and includes internal guidelines, reporting systems and the internal control system (ICS) which is reviewed by internal audit.

The Executive Board as a whole is responsible for managing risk throughout the CPI Europe and defines the business objectives as well as the related risk strategy.

CPI Europe's risk strategy provides instructions for managing the risks and opportunities arising from the corporate strategy on which it is based. Responsible management of these risks and opportunities in business operations is a top priority.

Download the documents below for more information:

Management

About Us

Investor Relations

IR news, reports and services for investors and analysts. We provide continuous, transparent and timely information about our company and CPI Europe shares.