22.01.2015

Investment market in Austria at pre-Lehman level– new buyers from the Middle East and Asia

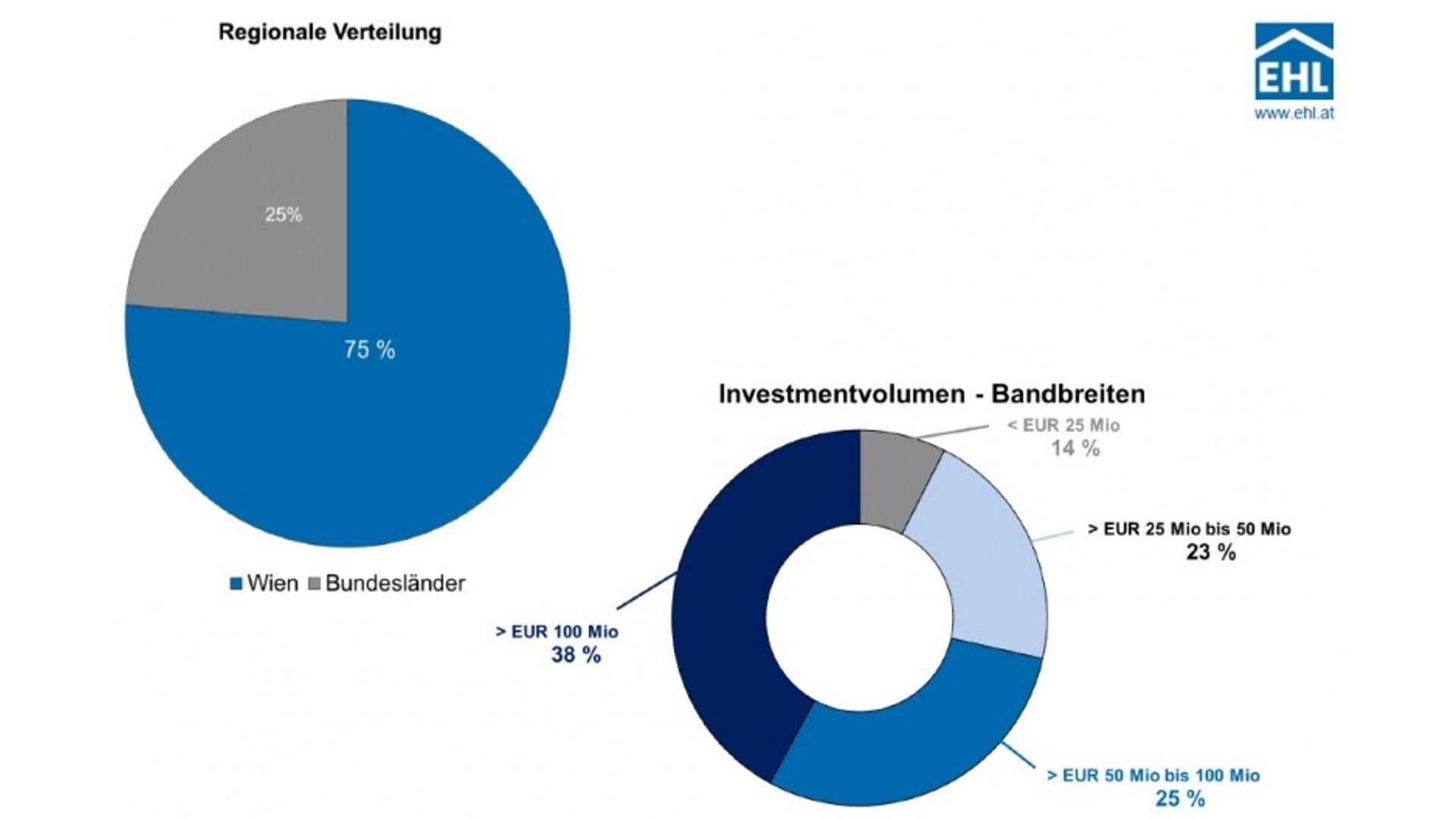

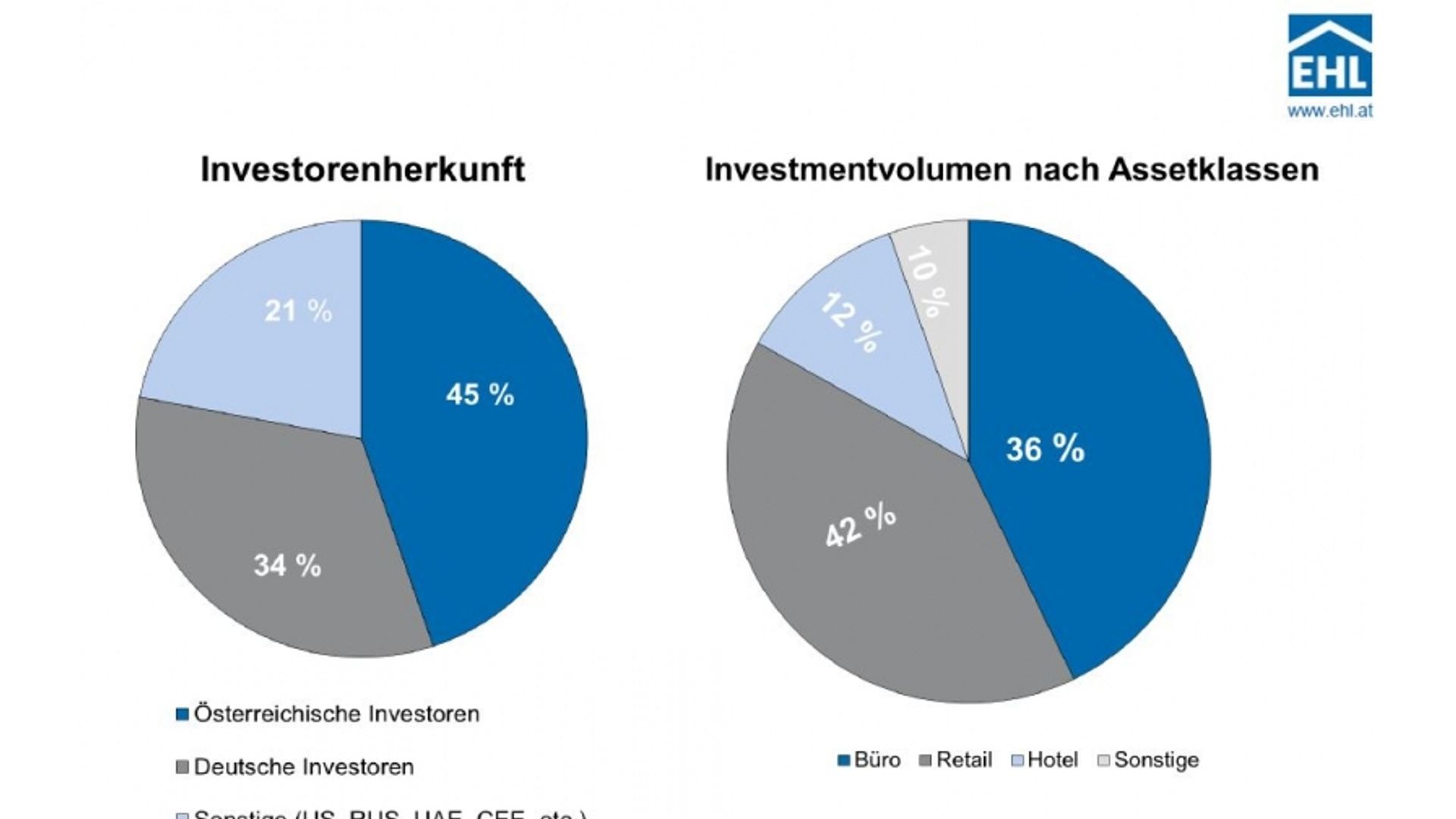

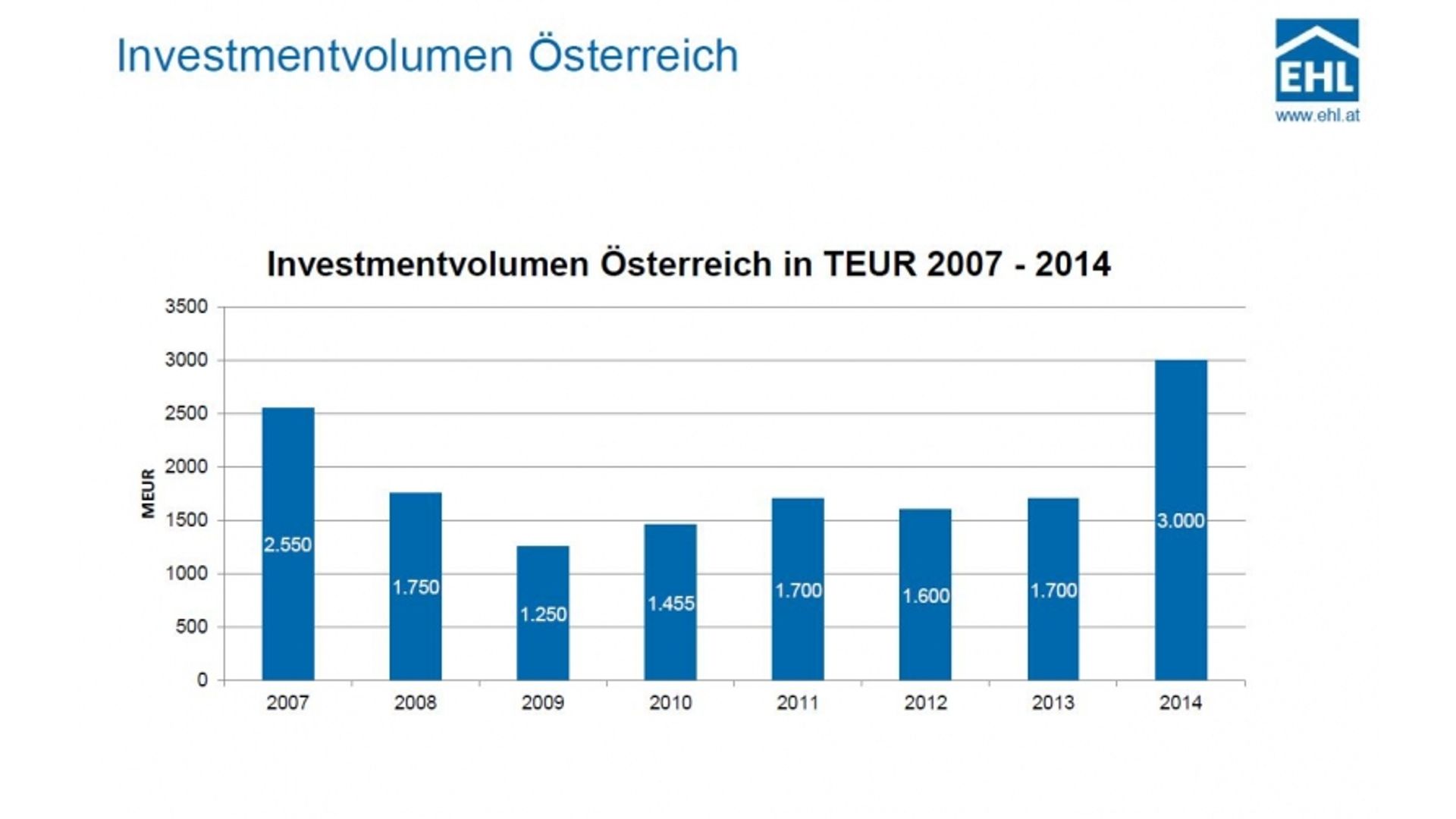

The Austrian real estate investment market broke all records in 2014: market volume nearly doubled compared to 2013 (EUR 1.7 billion) and for the first time again, at EUR 3 billion, reached the record level of the pre-crisis years up to 2007.With around 75% of the entire transaction volume, the lion's share was accounted for by the Vienna market in 2014 as well. The increase was especially strong in the retail property segment, which accounted for approx. 42%. The demand for office properties (about 36% of the transaction volume) was also extremely satisfying; hotels accounted for about 12% of the revenue from commercial properties.

The strong growth in large-scale transactions was especially striking. Seven sales with individual volumes exceeding EUR 100 million were concluded in 2014; in 2013 there was just one. Responsibility for this was attributed in particular to the growing involvement of international investors on the Austrian market. Investors from the Middle and Far East, for example from the United Arab Emirates and China, have discovered Austria as an investment target, but are actually interested almost exclusively in truly high-volume investment opportunities.

The interest on the part of investors from Russia and other post-Soviet states noticeably declined after the beginning of the crisis in the Crimea, but recovered again by the end of the year. This buyer group is active primarily in the middle range of EUR 15 million to EUR 50 million, in which Austrian and German institutional buyers such as real estate funds and insurers also make the majority of their investments. Banks focusing on their core business and selling properties are often still found on the seller side; the same is true for a number of insurers.

In the popular segment of residential real estate there are still too few good properties coming on the market, especially in the apartment buildings segment (“Zinshäuser”). In 2014, the transaction volume was around EUR 1.1 billion. However, the strong demand often leads to excessively ambitious asking prices on the part of the sellers.

The noticeable trend in previous years of apartment buildings being divided into condominiums and sold subsided somewhat in 2014. On the other hand, positive impetus has been provided by the structured bidding procedure, which is being used in a growing number of investment properties and appeals especially to institutional investors and insurers.

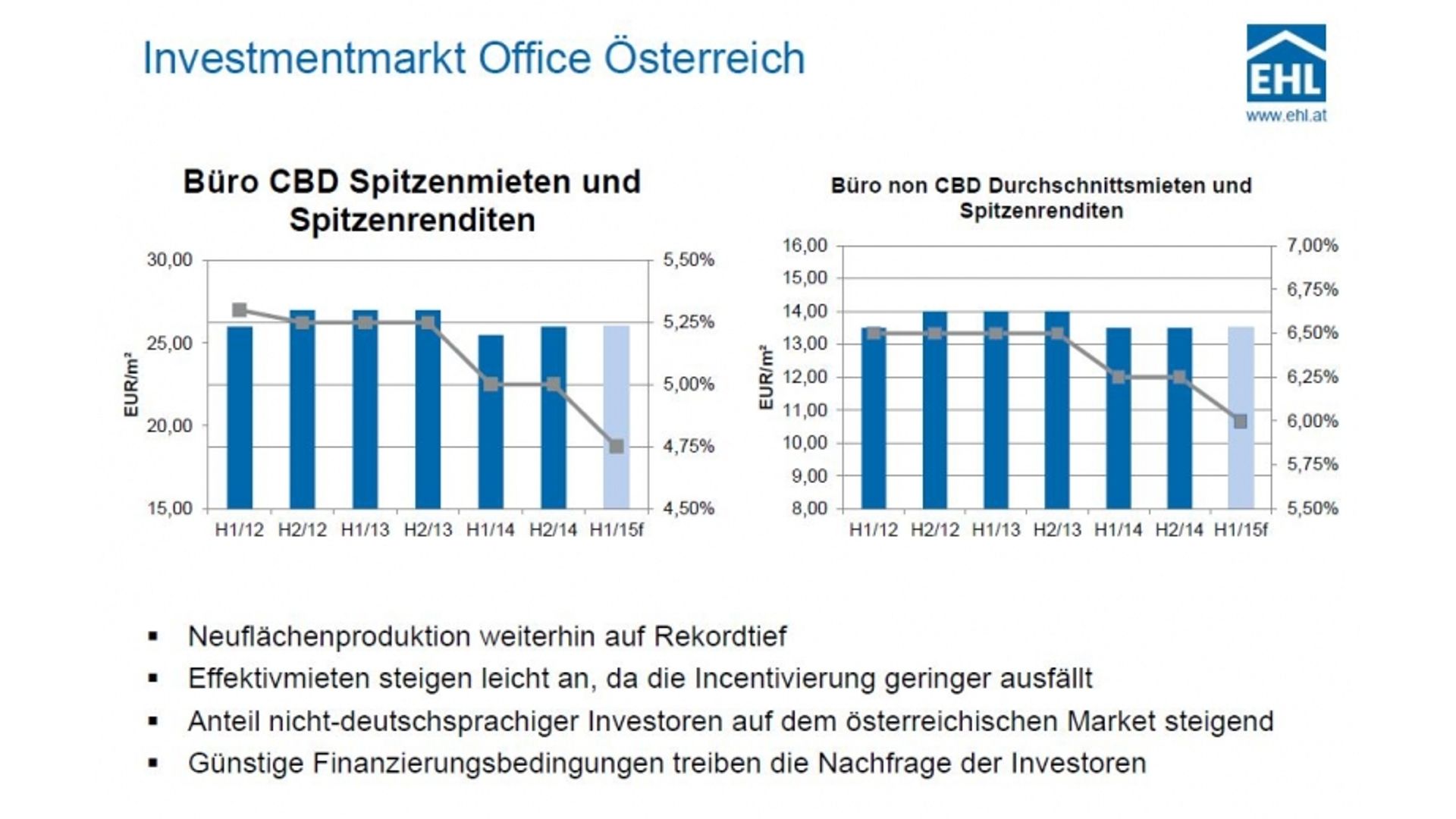

Prices reflect the positive development in volume on the real estate investment market. Yields remain under pressure; for prime properties in the office segment they are already below 5% and for first-class residential properties often even much lower than 4%. As a result investors are increasingly accepting properties from the non-core segment, despite a clear preference for the highest quality. The market for core products has been practically bought out. For this reason investors are switching to the as yet very good category of Core+, in which higher yields are also generated.

The outlook for 2015 is quite positive. We expect to maintain the high transaction volume of the previous year, or maybe even exceed it slightly. The price trend is steadily rising as well. For quality properties we tend to expect a continuous increase in prices. The gap between yields that can be generated on the money and capital markets and the yields on the real estate market is at least large enough that significant sums will continue to flow into the market.

The strong growth in large-scale transactions was especially striking. Seven sales with individual volumes exceeding EUR 100 million were concluded in 2014; in 2013 there was just one. Responsibility for this was attributed in particular to the growing involvement of international investors on the Austrian market. Investors from the Middle and Far East, for example from the United Arab Emirates and China, have discovered Austria as an investment target, but are actually interested almost exclusively in truly high-volume investment opportunities.

The interest on the part of investors from Russia and other post-Soviet states noticeably declined after the beginning of the crisis in the Crimea, but recovered again by the end of the year. This buyer group is active primarily in the middle range of EUR 15 million to EUR 50 million, in which Austrian and German institutional buyers such as real estate funds and insurers also make the majority of their investments. Banks focusing on their core business and selling properties are often still found on the seller side; the same is true for a number of insurers.

In the popular segment of residential real estate there are still too few good properties coming on the market, especially in the apartment buildings segment (“Zinshäuser”). In 2014, the transaction volume was around EUR 1.1 billion. However, the strong demand often leads to excessively ambitious asking prices on the part of the sellers.

The noticeable trend in previous years of apartment buildings being divided into condominiums and sold subsided somewhat in 2014. On the other hand, positive impetus has been provided by the structured bidding procedure, which is being used in a growing number of investment properties and appeals especially to institutional investors and insurers.

Prices reflect the positive development in volume on the real estate investment market. Yields remain under pressure; for prime properties in the office segment they are already below 5% and for first-class residential properties often even much lower than 4%. As a result investors are increasingly accepting properties from the non-core segment, despite a clear preference for the highest quality. The market for core products has been practically bought out. For this reason investors are switching to the as yet very good category of Core+, in which higher yields are also generated.

The outlook for 2015 is quite positive. We expect to maintain the high transaction volume of the previous year, or maybe even exceed it slightly. The price trend is steadily rising as well. For quality properties we tend to expect a continuous increase in prices. The gap between yields that can be generated on the money and capital markets and the yields on the real estate market is at least large enough that significant sums will continue to flow into the market.