08.04.2015

Long Zehetner would have been the top strategy on the Vienna Stock Exchange

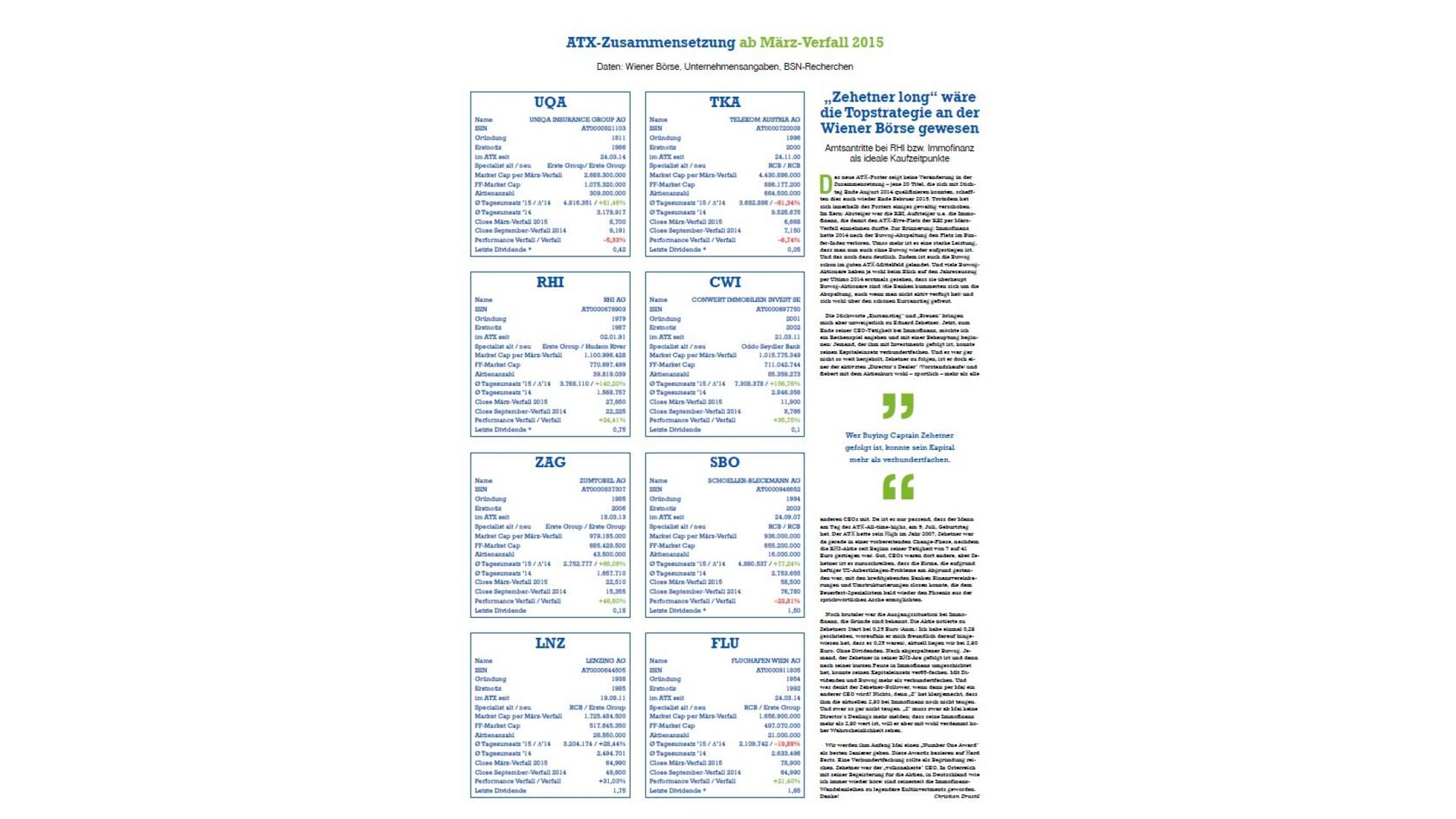

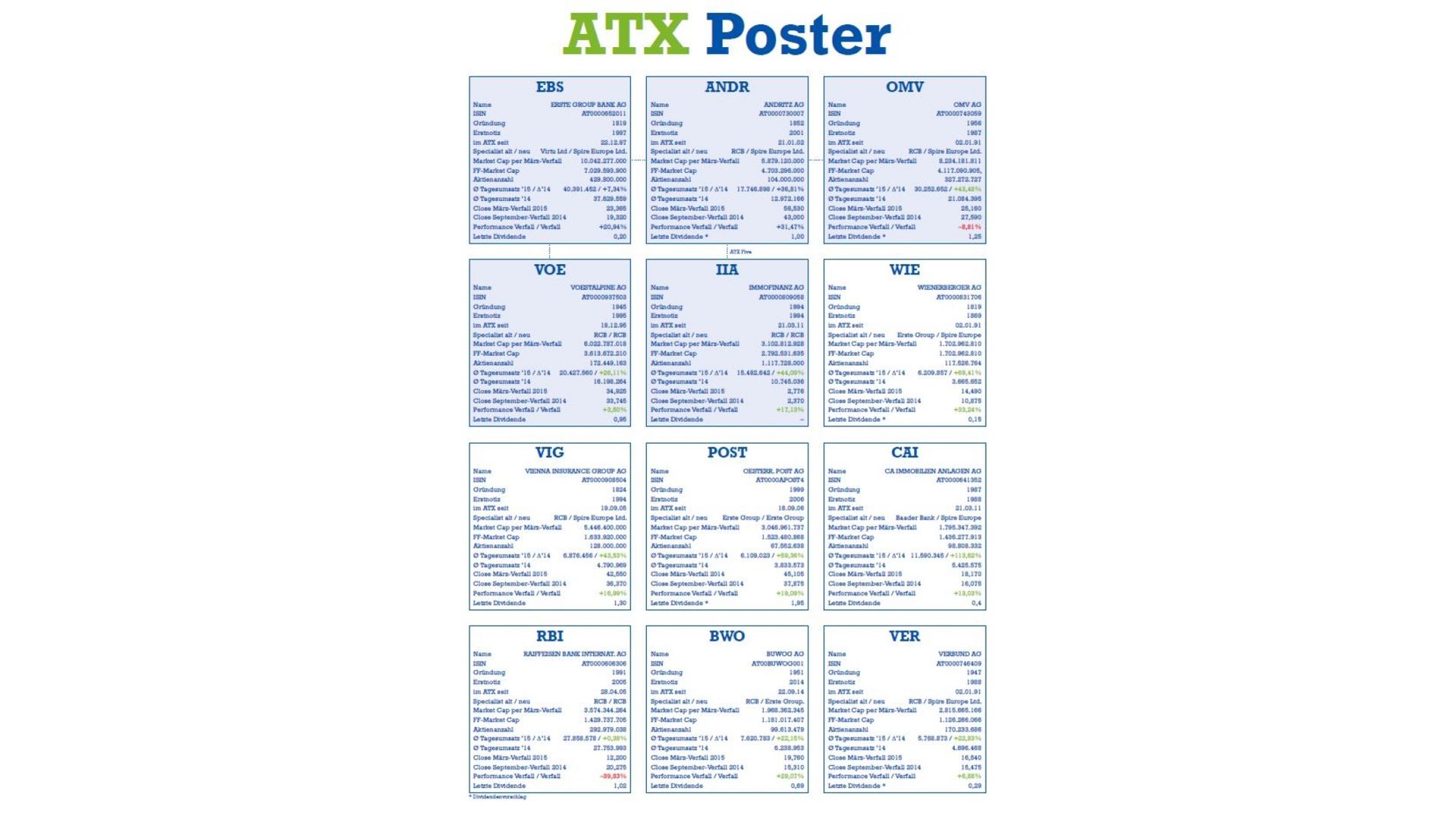

The new ATX Index remains unchanged in composition – the same 20 stocks which qualified at the end of August 2014 succeeded in doing so again at the end of February 2015. Nevertheless, there have been a number of substantial changes to the picture. In a nutshell: RBI was relegated, climbers included Immofinanz, which was thereby permitted to capture the ATX five position of RBI as of the March cut-off.By way of reminder, Immofinanz lost its place in the ATX five after the spin-off of Buwog in 2014. It is all the more notable an achievement to re-enter the index without Buwog - and to do so by a clear margin.

In addition, Buwog has also landed squarely in the midfield of the ATX. And many Buwog shareholders may well have only seen for the first time that they are actually Buwog shareholders when they looked at the year-end 2014 annual statement (the banks dealt with the spin-off, even when not actively directed to) and were probably delighted with the considerable sahre price increase.

The key words “price increase” and “delighted” bring me inevitably to Eduard Zehetner. Now, towards the end of his tenure as CEO at Immofinanz, I would like to set about a numbers game and begin with an assertion: somebody who has followed him with his or her investments could have increased their initial capital one hundred times over.

And it wouldn’t have been such a stretch to follow Zehetner, after all he is one of the most active “Director’s Dealer” (Executive Board buyers) and likely feels decidedly more for the share price than other CEO’s. Therefore it is only fitting that the man has his birthday on the day of the ATX all-time high, on the 9th of a summer month.

The ATX was at its high in 2007, Zehetner was at the time in a preparatory change-phase after RHI shares had risen from EUR 7 to EUR 41 since his appointment in 2001. Admittedly, others held the role of CEO there, but Zehetner is to be credited with the fact that the company, which was standing on the edge of the precipice due to severe US asbestos litigation problems, could close financial and restructuring negotiations with the lending banks, enabling the fireproof products specialist to rise again like the phoenix from the proverbial ashes shortly afterwards.

Even more extreme was the starting point at Immofinanz, the reasons are known. When Zehetner joined, the shares were quoted at EUR 0.25 (note: I once wrote EUR 0.28, whereupon he kindly pointed out that it was EUR 0.25), currently we are at EUR 2.80. Without dividends. And after the Buwog spin-off. Somebody who followed Zehetner in his RHI era and then, after his short break, switched into Immofinanz could have increased his capital investment by 65 times. With dividends and the Buwog spin-off by more than 100 times.

And what does the Zehetner-follower think when there will be a new CEO in May? Nothing, because the “Z” has made it clear that to him the current EUR 2.80 for Immofinanz is still not enough. In fact it is not even close. Although “Z” no longer has to register Director’s Dealings as of May, it is pretty certain that he wants to see his Immofinanz valued at more than EUR 2.80.

We will give him a “Number One Award” for best Restructurer at the beginning of May. These awards are based on hard facts. A one hundred times increase should suffice as reason. Zehetner was the most down-to-earth CEO. In Austria, with his enthusiasm for the shares, in Germany (as I hear time and again) during that time the Immofinanz convertible bonds became legendary cult investments.

Thanks, says ... Christian Drastil

(from Fachheft 31 / Expert Dossier 31: http://www.christian-drastil.com/fachheft-info/)

(08.04.2015)

In addition, Buwog has also landed squarely in the midfield of the ATX. And many Buwog shareholders may well have only seen for the first time that they are actually Buwog shareholders when they looked at the year-end 2014 annual statement (the banks dealt with the spin-off, even when not actively directed to) and were probably delighted with the considerable sahre price increase.

The key words “price increase” and “delighted” bring me inevitably to Eduard Zehetner. Now, towards the end of his tenure as CEO at Immofinanz, I would like to set about a numbers game and begin with an assertion: somebody who has followed him with his or her investments could have increased their initial capital one hundred times over.

And it wouldn’t have been such a stretch to follow Zehetner, after all he is one of the most active “Director’s Dealer” (Executive Board buyers) and likely feels decidedly more for the share price than other CEO’s. Therefore it is only fitting that the man has his birthday on the day of the ATX all-time high, on the 9th of a summer month.

The ATX was at its high in 2007, Zehetner was at the time in a preparatory change-phase after RHI shares had risen from EUR 7 to EUR 41 since his appointment in 2001. Admittedly, others held the role of CEO there, but Zehetner is to be credited with the fact that the company, which was standing on the edge of the precipice due to severe US asbestos litigation problems, could close financial and restructuring negotiations with the lending banks, enabling the fireproof products specialist to rise again like the phoenix from the proverbial ashes shortly afterwards.

Even more extreme was the starting point at Immofinanz, the reasons are known. When Zehetner joined, the shares were quoted at EUR 0.25 (note: I once wrote EUR 0.28, whereupon he kindly pointed out that it was EUR 0.25), currently we are at EUR 2.80. Without dividends. And after the Buwog spin-off. Somebody who followed Zehetner in his RHI era and then, after his short break, switched into Immofinanz could have increased his capital investment by 65 times. With dividends and the Buwog spin-off by more than 100 times.

And what does the Zehetner-follower think when there will be a new CEO in May? Nothing, because the “Z” has made it clear that to him the current EUR 2.80 for Immofinanz is still not enough. In fact it is not even close. Although “Z” no longer has to register Director’s Dealings as of May, it is pretty certain that he wants to see his Immofinanz valued at more than EUR 2.80.

We will give him a “Number One Award” for best Restructurer at the beginning of May. These awards are based on hard facts. A one hundred times increase should suffice as reason. Zehetner was the most down-to-earth CEO. In Austria, with his enthusiasm for the shares, in Germany (as I hear time and again) during that time the Immofinanz convertible bonds became legendary cult investments.

Thanks, says ... Christian Drastil

(from Fachheft 31 / Expert Dossier 31: http://www.christian-drastil.com/fachheft-info/)

(08.04.2015)