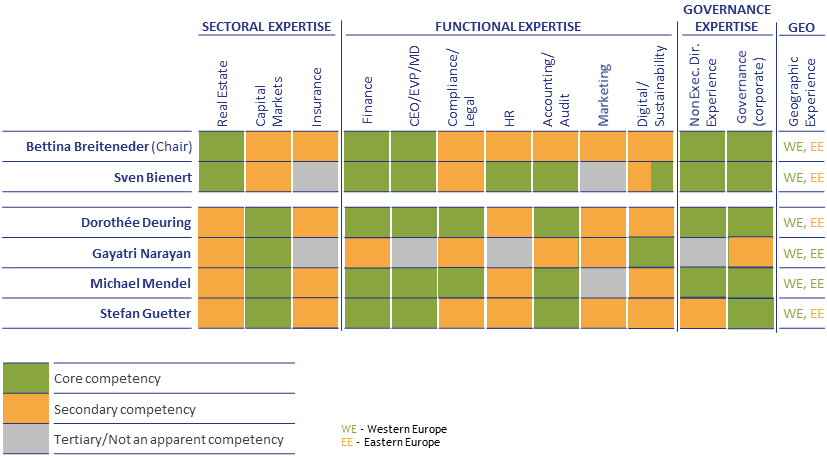

Qualification Matrix for the Supervisory Board

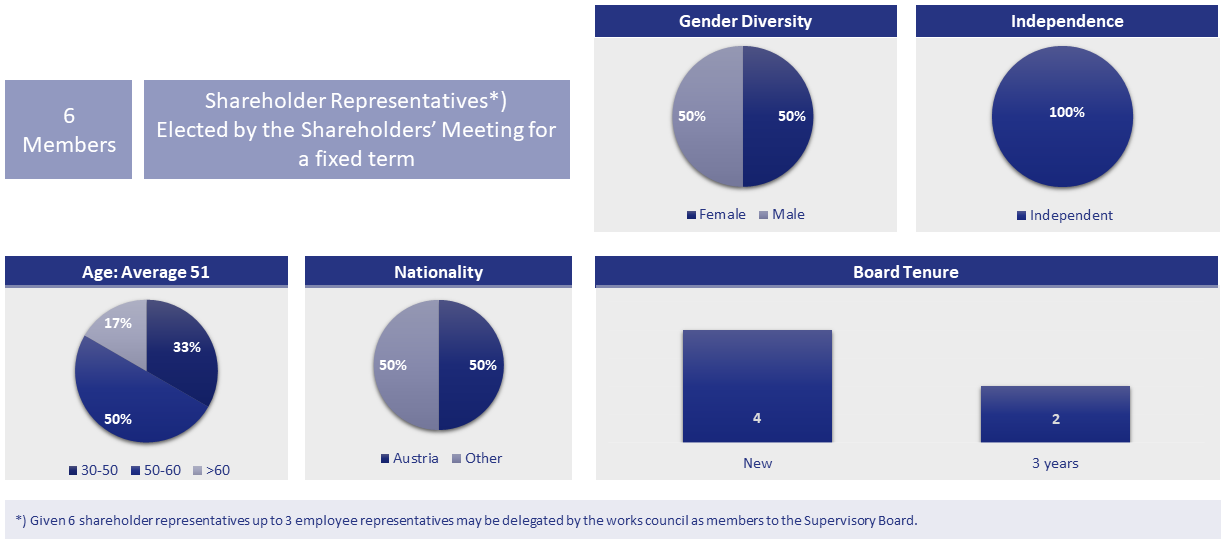

New composition of the Supervisory Board

The nominations of the new candidates are the result of an extensive selection procedure which was carried out in cooperation with external specialists based on a skills matrix for the Supervisory Board. This ensures constant availability of the necessary, broad-based expertise for the Supervisory Board to optimally exercise its tasks in the interests of the company and shareholders. The Supervisory Board of IMMOFINANZ will thus be increased to six capital representatives again.

If the candidates nominated by the Supervisory Board of IMMOFINANZ AG for the elections to the Supervisory Board are elected by the 28th Ordinary Shareholders’ Meeting, the Supervisory Board will in future consist of the following members:

Mrs. Bettina Breiteneder | Mr. Sven Bienert |

Dorothée Deuring | Gayatri Narayan |

Michael Mendel | Stefan Guetter |

Philipp Amadeus Obermair |

For new election to the Supervisory Board of IMMOFINANZ AG are proposed

Dorothée Deuring (independent) is an independent corporate finance advisor and member of a number of supervisory boards of international listed companies and has extensive experience in corporate governance, capital markets and corporate finance. Prior to starting her own business in 2014, she held management positions at UBS AG Europe, Bankhaus SAL. OPPENHEIM JR. & CIE and F. Hoffmann-La Roche AG.

Gayatri Narayan (independent) is a financial expert rooted in the real estate sector. During her career to date she has implemented several M&A projects and cross-border transactions in the CEE region, the Middle East and Africa. Most recently, Ms. Narayan, a British citizen, worked for Deutsche Bank AG in London.

Michael Mendel (independent) has long-standing management and supervisory board experience in the banking and finance sector. Among others, he was a member of the Management Boards of Bank Austria, HypoVereinsbank and Deputy Chief Executive Officer of Österreichische Volksbanken AG and immigon portfolioabbau AG. He currently serves as Chairman of the Supervisory Boards of the state-owned wind-down company HETA Asset Resolution and COFAG, the COVID-19 financing agency of the Austrian Republic. He is also a member of the Supervisory Board of Bausparkasse Wüstenrot and a member of the Investment Committee of Österreichische Beteiligungs AG ÖBAG.

Stefan Guetter (independent) has long-standing international experience in the finance and real estate sector and possesses extensive strategic know-how. Mr. Guetter started his career at the investment bank Merrill Lynch & Co Inc., where he held different management positions. Subsequently he worked for Dresdner Kleinwort, Aybrook Financial Partners Ltd and Akademia Residenz Berlin. Since 2019, he has been a partner and General Manager of London-based Gemcorp Capital LLT.

Continuing Supervisory Board members of IMMOFINANZ AG

Bettina Breiteneder (independent)

Chairwoman of the Supervisory Board

Many years of management experience in real estate, CEO, supervisory board functions, finance, accounting, audits, corporate governance, capital markets, human resources and insurance.

Sven Bienert (independent)

Vice-Chairman of the Supervisory Board

Extensive expertise in the areas of real estate, CEO, supervisory board functions, finance, accounting, audits, corporate governance and human resources.

The candidates will make a significant contribution to the support and control of the strategic orientation of IMMOFINANZ AG.

Christian Böhm and Nick J. M. van Ommen will terminate their membership in the Supervisory Board after 11 resp. 13 years at their own request. The Supervisory Board would like to thank Christian Böhm and Nick van Ommen for their commitment and long-standing support of IMMOFINANZ.

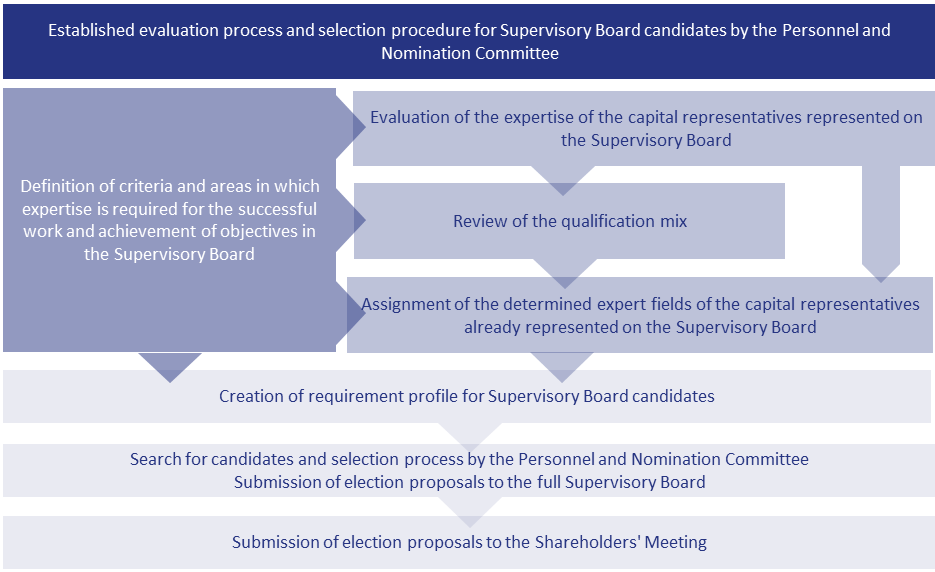

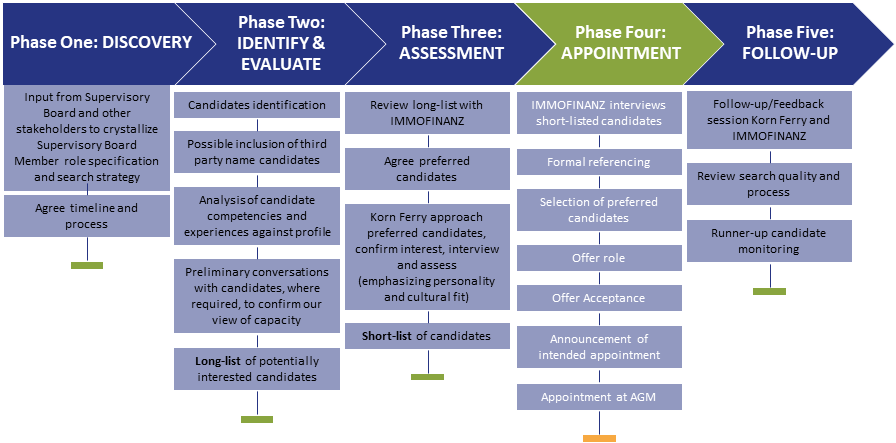

In order to achieve the best possible replacement in the Supervisory Board, the Supervisory Board of IMMOFINANZ AG has carried out a selection process on the basis of a qualification matrix. The process is shown in the diagram below:

The Personnel and Nomination Committee of the Supervisory Board dealt intensively with the question of the composition of the Supervisory Board. Based on the strategic orientation of IMMOFINANZ AG as one of the leading providers of commercial real estate solutions in its core markets and the objective of further value-creating growth through acquisitions and own project developments, those criteria and areas were evaluated, in which experience is required for the successful work and achievement of the objectives in the Supervisory Board. The expertise of the Supervisory Board (capital representatives) has been evaluated and compiled in a qualification matrix.

According to the evaluation of candidates based on the qualification matrix, the Personnel and Nomination Committee recommended the candidates to the Supervisory Board for new election. The Supervisory Board now proposes these candidates to the Shareholders’ Meeting for election. The candidates strengthen and complement the qualification matrix of the Supervisory Board and are perfectly suited to accompany and control the strategic orientation of IMMOFINANZ AG because of their experience and expertise.

Future qualification matrix of the Supervisory Board

(provided that the candidates nominated by the Supervisory Board are elected):

If the candidates are elected, there will be full gender diversity with an equal number of women and men among the capital representatives in the Supervisory Board and, consequently, one of the best diversity ratios among all listed companies included in the Austrian ATX.